Storage REITs Enjoy a Boom

Kennards Self Storage is pleased to share this article from the Wall Street Journal which observes the performance of the Storage Real Estate Investment Trusts in the USA, against other property sectors.

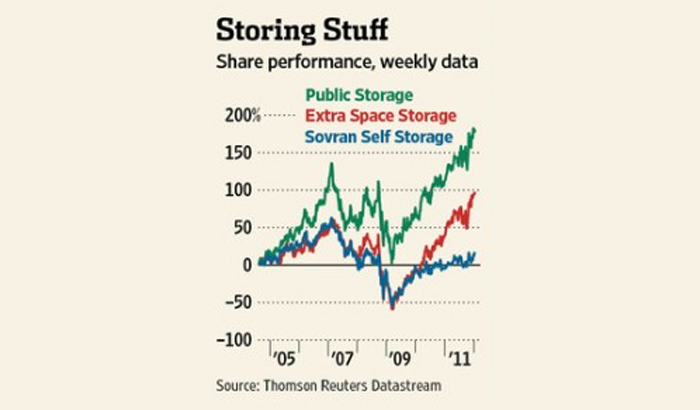

The storage sector has enjoyed the strongest returns of all property classes.

One of real estate’s least-exciting businesses—warehouses that allow people to store their unused sofas, lamps and other household goods—have become a hit with investors.

The widely watched reality-TV show, “Storage Wars,” which follows investors as they bid on repossessed storage lockers in search of hidden treasure, put self-storage on the pop-culture map.

But the storage companies themselves have turned out to be winners, too, as their stock prices surge. Last year, the stocks of real-estate investment trusts in the self-storage business posted a total return of 35.4%, the strongest gain of any REIT sector for the second consecutive year. Those results greatly outpaced the 8% return for all REITs, as measured by the Dow Jones All REIT Equity Index.

Profits in storage “far exceeded where most thought they would come in,” said Michael Knott, an analyst at Green Street Advisors. “Almost every situation in life can create demand for self-storage, like moving, divorce and getting married, that is irrespective of where the economy may be.”

The foreclosure crisis also has boosted demand for storage space as families downsize into smaller rental housing.

Among the four self-storage REITs tracked in the Dow Jones index, Extra Space Storage Inc., the second-largest public storage operator with 882 facilities in 34 states, packed the biggest punch, with a 2011 total return of 43%. Public Storage, the largest operator, had a return of 36%. Sovran Self Storage Inc. returned 21.35%, and CubeSmart returned 14.97%.

While most self-storage companies performed well, analysts said that Extra Space, based in Salt Lake City, benefited more than others because customers are drawn to its newer facilities located in densely populated markets. That allowed the company to increase occupancy 3.4% in the third quarter to 89.1%, the company’s highest-rate ever for a third quarter. Extra Space asking rents jumped 3% in the third quarter compared to the same period a year earlier and discounts dropped 9%

“Along with the rest of the industry, Extra Space had a very good year, including increased occupancy and rising rents,” said Paul Adornato, an analyst at BMO Capital Markets. He said he anticipates a favorable business environment for the company this year. Mr. Adornato also is a satisfied customer. He is renting an Extra Space facility in Brooklyn, N.Y., for six months as he remodels his home.

Still, Mr. Adornato has an “underperform” rating on the stock partly because he doesn’t believe occupancy can rise much higher. “We think some of the easy gains from increasing occupancy may no longer be available to the company,” Mr. Adornato said. “Investors may look elsewhere…in the REIT world for better returns.”

Self-storage has long been viewed as a stable business because it is an expense borne out of necessity. “We are a solution to a problem or a challenge that has been life-changing for an individual,” said Spencer Kirk, chief executive of Extra Space. “It’s not glamorous, but it’s stable,” he said. “It’s recession-resistant. and if properly managed, it can produce a great return for an investor.”

Mr. Kirk noted that during the downturn, public-storage companies only suffered mild revenue declines compared with the double-digit drops by other commercial landlords. And, while Extra Space did drop rents for new tenants, it continued to raise rental rates for existing customers every month.

The company wasn’t completely unscathed by recessionary pressures. Like its rivals, Extra Space saw an exodus of longer-term tenants of seven to 10 years who ditched the storage facilities to save money.

The company also was the most-vulnerable among the four storage REITs because it used hefty amounts of leverage to fund an ambitious development pipeline.

Extra Space repaired its balance sheet by securing bank loans on some 800 properties that it used as collateral. In addition, the company also permanently closed its development business in 2009 because it couldn’t get financing to build new facilities.

Mr. Kirk says the business will continue to benefit from higher rents in part due to the absence of new competition. “There has been virtually no new supply added over the last few years. As an existing operator for self-storage, it bodes well for the future,” he said.

By A.D. PRUITT

Categories

- Business Storage

- Car, RV and Boat Storage

- Centre Expansions and Upgrades

- Corporate

- Culture

- Customer Feedback

- Deposit Boxes

- Gun Storage

- Industry Facts

- Kennards Supporting The Community

- KSS In The News

- Latest News

- Locker Lovers

- Moving Boxes

- Neville Kennard

- New Storage Centres

- Press Releases

- Region Guides

- Sam Kennard

- Self Storage

- Wine Storage

Other stories of interest

Are you in need of extra space to store your belongings? Look no further than Kennards Self Storage, the newest addition to the Pakenham community!

If you’re looking for an affordable self storage solution in Melbourne’s Northern Suburbs, you’re sure to find the right storage solution at an affordable price; it might even be the cheapest storage solution available in Melbourne’s Northern Suburbs.

No matter what the reason is, everyone needs extra space at some point. The ease of storing your goods are facilitated by the self storage industry. They offer storers a secure and well managed space to store valuables

-700-x-410.jpg?width=700&height=407&ext=.jpg)